Ambitions 2025

Ambitions 2025

The period ahead of us is unique: A “medium term” in no longer observable. It has made way for a “short term” horizon, which is particularly opaque under the combined effects of multiple crises, and a true “long term”, which has never been so clearly expressed by politicians and public opinion: decarbonisation of energy, protection of biodiversity and the environment, healthcare solutions for increasingly ageing populations, necessary technical progress in agriculture and agri-food and social inclusiveness which is essential for the stability of our societies.

A new plan based on the proven formula for success

WORKING EVERY DAY IN THE INTEREST OF OUR CUSTOMERS AND SOCIETY

The highest aim of our Group is to be a trustworthy partner for all customers and to work every day in their interests and those of society.

Since the creation of the group, we have expressed the desire to be socially useful: Financing agriculture, providing households with access to banking services, facilitating the acquisition of residential property... These collective goals have been real engines of growth for the group.

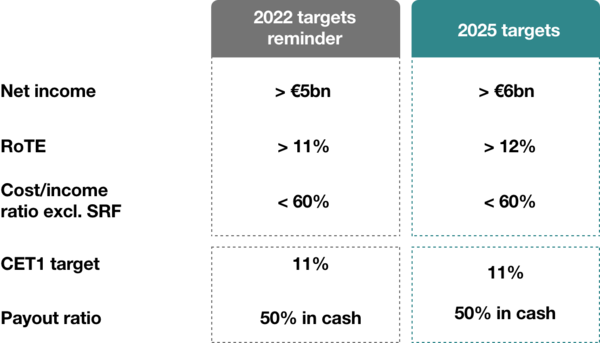

The group has recently demonstrated the relevance of this model. It has achieved steady growth and good performance despite numerous challenges, including the crisis brought on by the Covid pandemic. Over the last six years, Crédit Agricole S.A.’s earnings have grown by an average of 5% per year. In 2021, Crédit Agricole S.A. again achieved the financial targets of the 2022 Mid Term Plan one year ahead of schedule, while strengthening its position. Strong organic growth complemented by targeted partnerships and acquisitions are now the targets for 2025.

Our roadmap remains clear:

We help all our customers overcome difficult challenges in the short term.

We are committed to being a facilitator and accelerator of all these social transitions. We are acting for tomorrow.

We will achieve these goals – thanks to our proven business model, which combines usefulness with universality, and our experience as a committed player in times of social transitions.

Our 2025 trajectory is one of amplification: Thanks to strong organic growth potential, we are looking at over one million additional customers for Crédit Agricole Group. Our business lines are leading in Europe and will continue to develop and expand their offers to answer changing needs and to support transitions. The Medium Term Plan also aims to generate, for Crédit Agricole S.A., net income Group share of more than €6 billion Euros and strengthen profitability, which is already among the best in Europe, with a return on tangible equity of more than 12%.

In the long term, to 2030 and beyond, the Group is restructuring and launching two new business lines that will benefit society and offer opportunities for growth. We are creating Crédit Agricole Transitions & Energies to make energy transitions accessible to all and accelerate the advent of renewable energy. We are creating Crédit Agricole Santé & Territoires to facilitate access to healthcare and ageing services well across all regions.

“It is now easier to think long-term than it is to predict the short term. Thanks to our universal banking model, we continuously outperform, and this allows us to support each of our customers and to act for tomorrow. By creating two new business lines to make energy transition accessible to all, and to facilitate access to care and ageing services, we are extending our mission as shapers of the future.”

Philippe Brassac, CEO Crédit Agricole

Our identity: Societal Usefulness X Universality

1. Societal Usefulness

Working in the interest of society as a whole, to make progress available to everyone and to address new needs and all major societal transformations.

2. Universality

Usefulness for everyone, from the poorest to the wealthiest, from small businesses to large corporations, across all regions and through all channels.

Target for 2025: More than one million additional customers.

- Enriching our product range to address new customer needs

- More affordable, sustainable and digital offers

- Increasing equipment rates, e.g., protection insurance, savings, real estate

- Accelerating customer acquisition in all our markets >1m additional Group retail banking customers by 2025

In addition to this organic growth momentum, we expect to establish new partnerships with financial players and industry leaders and to develop technological partnerships.

Through targeted acquisitions, we aim to strengthen our positions in our home markets and expand our international activities with a focus on Europe in line with our profitability criteria.

Development of partnerships and strategic acquisitions

PARTNERSHIPS

- Distribution partnerships with financial players

- Technological partnerships

- Partnerships with industry leaders

STRATEGIC ACQUISITIONS

- Strengthening our positions in our domestic markets

- Expanding our international activities, primarily in Europe …

- … while meeting strong profitability criteria (ROI > 10% in 3 years)

The Medium Term Plan targets in figures:

You can find more information about the ambitions and the strategy of the Crédit Agricole Group on the international website.